EV over the years

The evolution of Electric Vehicles (EVs) has traversed a remarkable journey catalyzed by technological innovation, environmental imperatives, and shifting consumer preferences. Emerging in the 19th century as experimental vehicles, EVs experienced sporadic popularity until the mid-20th century, when the rise of gasoline-powered cars and the abundance of fossil fuels overshadowed their appeal. However, the late 20th century witnessed renewed interest due to mounting concerns about air pollution and climate change, sparking a revival of EV research and development.

The modern era of EVs truly took off in the 21st century, characterized by a series of significant milestones. Introducing hybrid electric vehicles (HEVs) in the early 2000s, notably the Toyota Prius, set the stage for the gradual reintegration of electric technology into the automotive landscape. Fast-forward to the 2010s, and the launch of the Nissan Leaf in 2010, followed by Tesla's impressive Model S, Model 3, Model X, and Model Y, underscored the transformative potential of EVs. These vehicles showcased improved battery technologies, longer ranges, and increased performance.

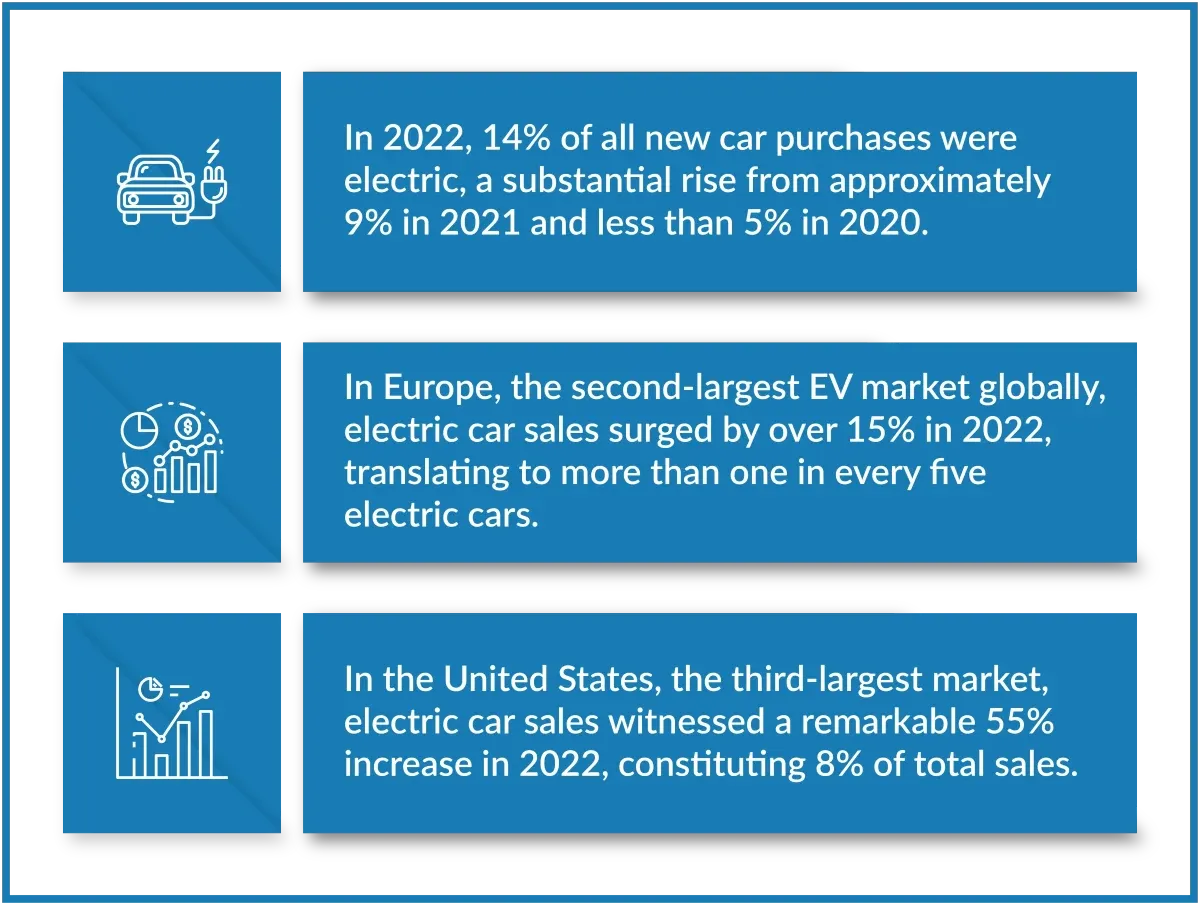

Recent statistics highlight the accelerating momentum of EV adoption.

Anticipations for the EV market remain optimistic, with projections indicating that EV sales will reach 14 million by the close of 2023, marking a robust 35% year-on-year growth. This acceleration in new EV purchases is expected to gain further traction in the latter half of this year.

The 2020s herald even greater advancements. Breakthroughs in battery chemistry have led to increased energy density and decreased costs, propelling EVs into the mainstream. The push for sustainability and the expansion of charging infrastructure further bolsters EV growth. The automotive landscape is diversifying, with legacy automakers and startups unveiling various electric models across various segments, from compact cars to SUVs and trucks.

As the 21st century unfolds, the evolution of EVs continues to accelerate. With ongoing innovation, increasing affordability, and a growing global commitment to sustainability, electric vehicles are poised to reshape how we drive, transforming our transportation systems and our impact on the planet.

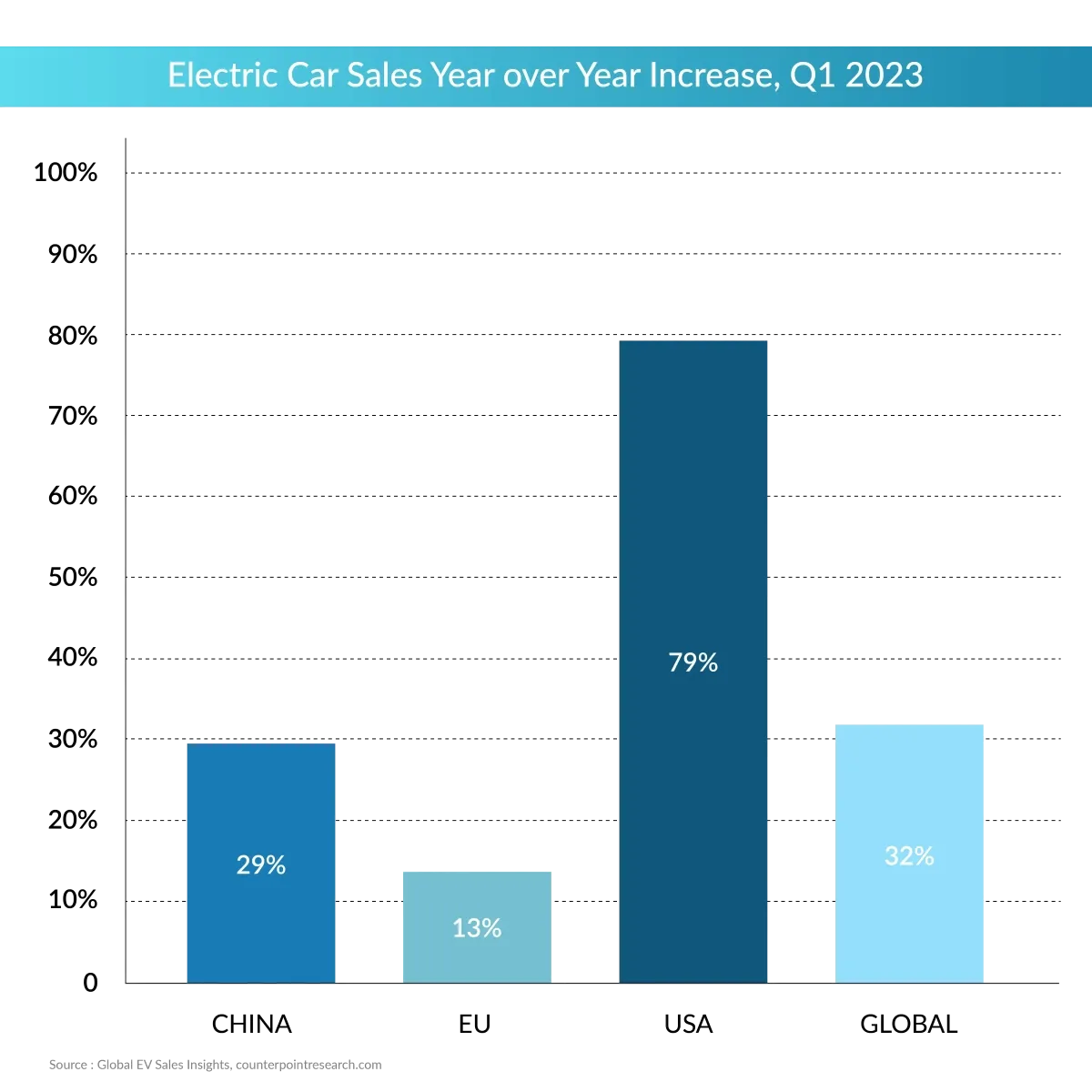

Markets are set to see faster adoption

Numerous global markets are on the cusp of a swift adoption wave for intelligent electric vehicles (EVs), propelled by a blend of government incentives, technological advancements, and evolving consumer preferences. Although electric car sales have generally been modest in markets beyond the major players, there were noteworthy growth trends in India, Thailand, and Indonesia during 2022. According to Counterpoint Research, the United States outpaced Germany to claim the position of the world's second-largest EV market in the first quarter of 2023, with China maintaining its position as the global leader.

China is the preeminent global market for new energy vehicles (NEVs). The Counterpoint Research reported a remarkable 13.1 million NEV ownerships in China by the close of 2022. China enjoys inherent advantages in its supply chain, resulting in reduced logistics, labor, and land management costs.

ACEA's 2023 quarterly report states that the EU car market saw a 28.8% increase in passenger car registrations, with Spain and Italy leading. This surge is attributable to the mounting demand for EVs, an easing of supply chain bottlenecks, and a deceleration in Europe's inflation rate. Norway, setting its sights on ending the sales of internal combustion engine vehicles by 2025, achieved a remarkable milestone in 2022, with 80% of new car sales being electric. As recent policy pronouncements stimulate consumer demand, the United States is expected to double its market share to 20% by the decade’s end.

How EV in two-wheeler adoption is faring against the four-wheeler segment

The divergence in Electric Vehicle (EV) adoption between the two-wheeler and four-wheeler segments is striking. Recent data showcases the impressive progress made by electric two-wheelers compared to their four-wheeled counterparts.

The surge in electric adoption within the two-wheeler segment can be attributed to several factors, including affordability, the demands of urban mobility, and their efficiency advantages. Projections indicate that the two-wheeler market is poised to experience a compound annual growth rate of 8.7% until 2029, ultimately reaching a market value of approximately USD 218 billion. To illustrate, in 2021, electric two-wheelers accounted for a mere 4% of total two-wheeler sales in India.

However, this figure is anticipated to soar to 30% by 2030. North America and Europe have a relatively small two-wheeler market. However, seeing the growth potential, brands from this region have started to develop their first electric offerings.

Drawing from the experiences of the four-wheeler market, government regulations supporting electric two-wheelers could potentially trigger a significant transformation and boost sales. China is a prime example, leading the world in electric vehicle (EV) adoption rates with its robust government support for electrification.

On the other hand, the adoption of electric four-wheelers is on the rise. According to the Global EV Outlook 2023 , more than 2.3 million electric cars were sold in the first quarter, marking a 25% increase compared to the same period in the previous year. Evolving government regulations and legislation primarily drive this growth.

For instance, the European Union has adopted new CO2 standards for cars and vans, aligning them with the 2030 objectives outlined in the 'Fit for 55' legislative package. In the United States, the Inflation Reduction Act (IRA), coupled with several states' adoption of California's Advanced Clean Cars II rule, has the potential to achieve a 50% market share for electric cars by 2030, in line with the national target. The proposed emissions standards recently put forth by the US Environmental Protection Agency are expected to bolster this share further.

Challenges for EV adoption in Two wheeler/four-wheeler

| Two-wheelers | Four wheelers | |

|---|---|---|

| Affordability | Higher initial price tags than their internal combustion engine counterparts due to battery costs. | High upfront costs associated stemming from battery expenses, pose a barrier to widespread adoption. |

| Charging infrastructure | The availability and accessibility of charging stations, crucial for EV viability, remain inconsistent, especially in rural regions | Four-wheeler TVs need a more expansive and reliable charging infrastructure in urban and long-distance settings |

| Charging duration | Despite the current fast-charging technologies, the time taken to charge is longer than conventional refueling | There is limited availability of fast-charging stations |

| Battery life and disposal | Implementing efficient battery swapping systems as an alternative to alleviate charging time concerns poses technical and logistical challenges | Battery life and replacement concerns raises questions about the longevity of EVs and the sustainability of battery disposal |

In the realm of two-wheelers, the adoption of electric vehicles (EVs) face such notable hurdles.

Addressing these multifaceted challenges necessitates collaborative efforts from various stakeholders, encompassing technological innovations, supportive policies, and widespread awareness campaigns.

Smart EV vs. Traditional EV

Connected EVs, also known as smart EVs, go beyond the basic electric propulsion system. Connected Electric Vehicles (EVs) represent a significant evolution in electric mobility compared to traditional EVs. These two categories share the commonality of being powered by electricity, but they differ in their integration of advanced digital technologies and connectivity features. MarketsandMarkets Research shows that the global smart electric drive market size is expected to grow from USD 915 Million in 2021 to USD 4,245 Million by 2026.

Today, the connected EV market is steadily gaining prominence over traditional EVs due to its advanced digital capabilities and enhanced user experience. They have advanced sensors, internet connectivity, and sophisticated software systems. These elements enable various capabilities, such as real-time data collection and analysis, remote diagnostics, over-the-air updates, and vehicle-to-vehicle communication. Connected EVs can also interact with smart infrastructure, allowing them to receive traffic and weather information, find charging stations, and optimize routes for efficiency. These technologies enhance the driving experience, provide convenience, and offer additional capabilities to integrate the vehicle into the digital ecosystem.

As consumers increasingly value connectivity and digital integration, the connected EV market is poised for robust growth, surpassing traditional EVs by offering a more technologically advanced and user-friendly electric vehicle option.

Upstream value chain for enabling connected EVs

The upstream value chain for enabling connected Electric Vehicles (EVs) encompasses a complex network of industries and technologies that collaborate to deliver the foundational components and services required for the seamless integration of EVs into the digital ecosystem.

- At its core, the upstream value chain begins with the production of EVs themselves, including the manufacturing of electric powertrains, batteries, and vehicle components. This includes the development of cutting-edge battery technology to enhance range and performance.

- Extends to developing sensors, IoT (Internet of Things) devices, and connectivity hardware integrated into EVs. This encompasses the production of high-performance microprocessors, GPS modules, and cellular communication chips.

- Software development plays a pivotal role, encompassing the creation of operating systems, firmware, and applications that enable EVs to communicate with the cloud, other vehicles, and infrastructure. Cybersecurity measures are also crucial to safeguard data and vehicle operations.

- Telecommunication networks and cloud computing providers form another integral part of the chain, ensuring robust connectivity and data storage for EVs. Moreover, renewable energy sources contribute to the value chain by supplying clean power for charging infrastructure.